on

Verdure

- Get link

- X

- Other Apps

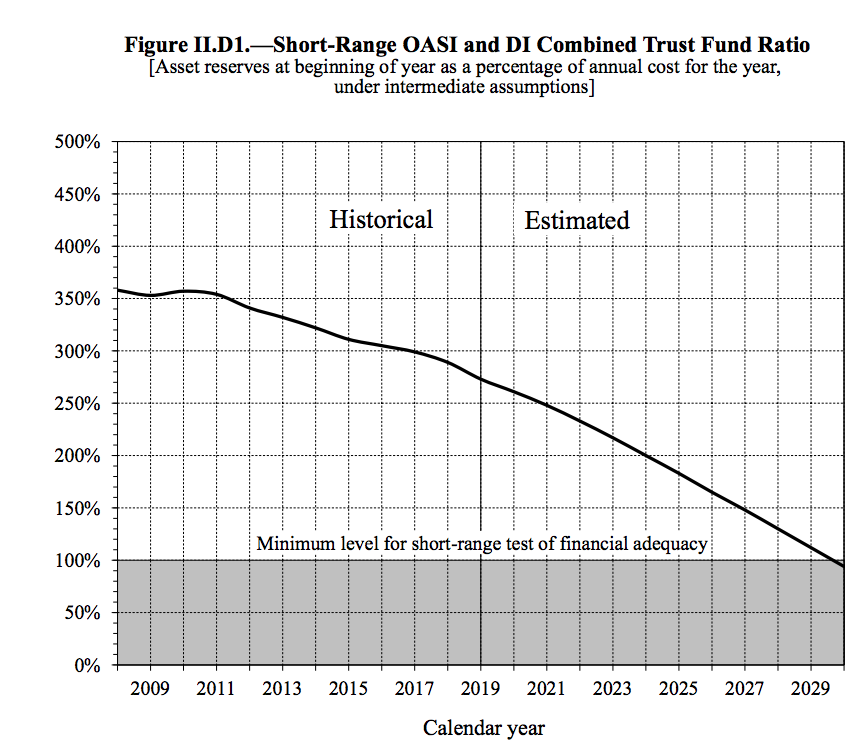

Today, the Trustees of the Social Security and Medicare trust funds released their 2020 report on the financial status of both programs (report, summary). The numbers don’t look good. I say this noting also that the projections do not take into account any impacts on mortality, health care costs and taxes revenue from COVID-19. Thus, one could consider these Trustees report projections optimistic. Regardless, here is where we stand:

Social security trust fund will run out of funds in 15 years. The Old-Age and Survivors Insurance (OASI) Trust Fund can pay scheduled benefits on a timely basis until 2034. Starting in 2035, incoming tax revenue will only be able to pay for 76% of scheduled benefits.

Social Security finances are getting worse. With the baby boomers retiring, Social Security’s financial situation is projected to worsen. In the next decade, deficits will be $2 trillion, equivalent of 0.7% percent of Gross Domestic Product (GDP). Deficits will exceed 1.2% percent of GDP by 2040 and 1.5% percent of GDP by 2094.

Medicare Trust Fund will be exhausted in 7 years. Medicare’s Hospital Insurance (HI) Trust Fund, which pays Medicare Part A inpatient hospital expenses will be able to pay scheduled benefits until 2026, the same as reported last year. Starting in 2027 (in just 7 years!) continuing program income will be sufficient to pay only 90% of scheduled benefits. Part B benefits, however, are fully financed as Medicare requires that beneficiary premiums each year are set to meet the next year’s expected Part B costs.

Social security and Medicare make up more than 2 out of every 5 dollars of federal spending. These two programs alone accounted for 41% of federal expenditures in FY 2019.

As the Committee for Responsible Federal Budget stated, “Time is running out to save Social Security.”

Comments

Post a Comment