on

Verdure

- Get link

- X

- Other Apps

Kaiser Family Foundation has a nice overview of how Medicaid pays for prescription drugs. Below, I except from this helpful piece, but do check out the full article here.

One point that many may not realize is that State Medicaid Agencies do not actually buy pharmaceuticals directly from manufacturers.

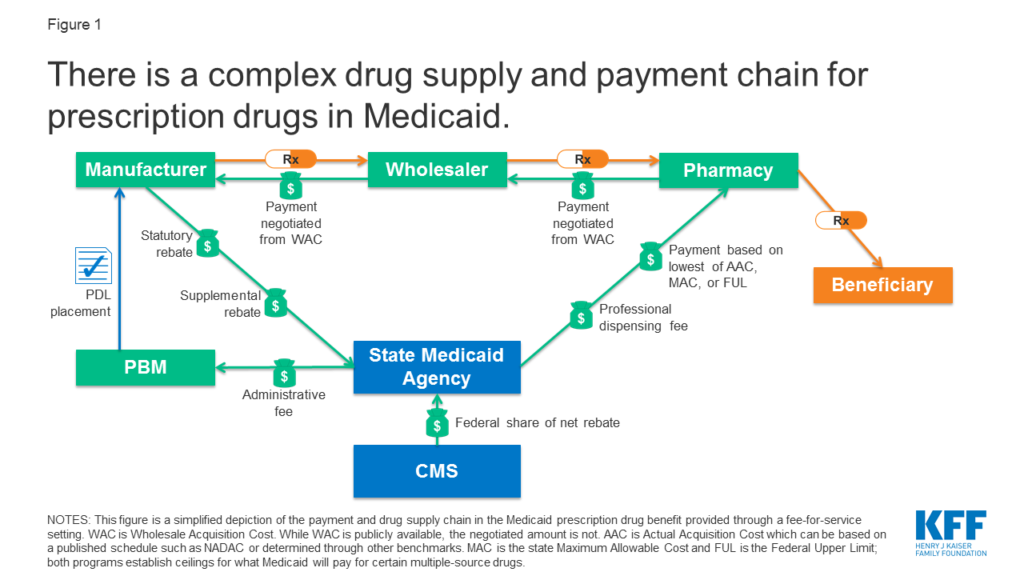

Rather, they reimburse retail pharmacies that fill prescriptions written for Medicaid enrollees. The amount the pharmacy receives is based on the ingredient cost of the drug and professional dispensing fees paid by Medicaid, plus any cost sharing paid by the beneficiary (Figure 1). For beneficiaries who receive their drug benefit through managed care organizations (MCOs), MCOs reimburse the pharmacy, usually through the use of a PBM.

Medicaid just pays for drug cost plus dispensing. Dispensing costs typically is between $9 and $12 per prescription. Dispensing fees are much higher in Alaska and some states give higher dispending fees for Federally Qualified Health Centers (e.g., Wisconsin). Simple enough, right?

The ingredient cost, however, isn’t so simple. Medicaid won’t pay any amount for the ingredient cost; it just doesn’t reimburse pharmacies for whatever they pay. Instead:

Payment for ingredient cost is governed by average acquisition cost (AAC), which is the benchmark for setting payment for ingredient cost, capped at the lower of federal upper limits (FULs) or state maximum allowable costs (MAC) for some drugs… To determine AAC, states may survey pharmacies, use national survey data, or use the AMP data that manufacturers already are required to report to enable calculations of federal rebates and FUL pricing…The 2016 rule also created the NADAC [National Average Drug Acquisition Cost], a federal survey of pharmacies that helps states to determine AAC.

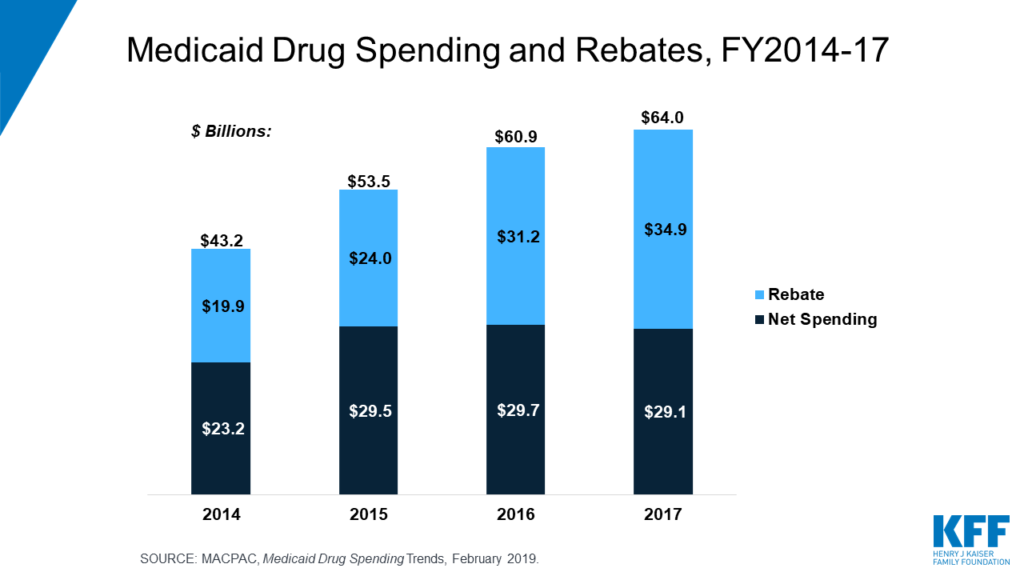

Rebates for Medicaid drugs are enormous, offsetting more than half of drug spending.

Under the Medicaid Drug Rebate Program, Medicaid receives a rebate for prescription drugs reimbursed under the program. Rebates are calculated based on a share of the average price paid to manufacturers and include an inflationary component to account for rising drug prices over time. Thus, the larger the gross price of a drug and the faster the price increases over time, the larger the rebate that Medicaid receives…In 2018, Medicaid spent $60 billion on drugs and received $36 billion in rebates.

Thus, while drug list prices get a lot of headlines in the press, actual cost paid is much lower, especially as rebates have grown over time. For instance, between 2016 and 2017 Medicaid drug spending increased by $3.1 billion. After taking into account rebates, however, net drug spending between 2016 and 2017 actually fell by $0.6 billion.

Many people believe Medicaid beneficiaries get drugs for free. This is not necessarily the case. Beneficiaries may be charged a co-pay of up to $4 for preferred drugs and $8 for non-preferred drugs for individuals in income ≤150% of the federal poverty level (FPL). There are slightly higher copay maximums for higher-income Medicaid beneficiaries.

With the rise of Medicaid managed care, however, there are even more intermediaries. In fact, “approximately two-thirds of Medicaid gross drug spending was administered through managed care”. Further State Medicaid Agencies may use pharmacy benefit managers (PBMs) for both fee-for-service and managed care organization (MCO) administration of drug benefits. Note that MCOs are not subject to the same drug price rules as fee-for-service benefits.

There is much more to learn, but hopefully this introductory primer was helpful. The figure below provides a nice summary of Medicaid’s approach to paying for prescription drugs.

Comments

Post a Comment